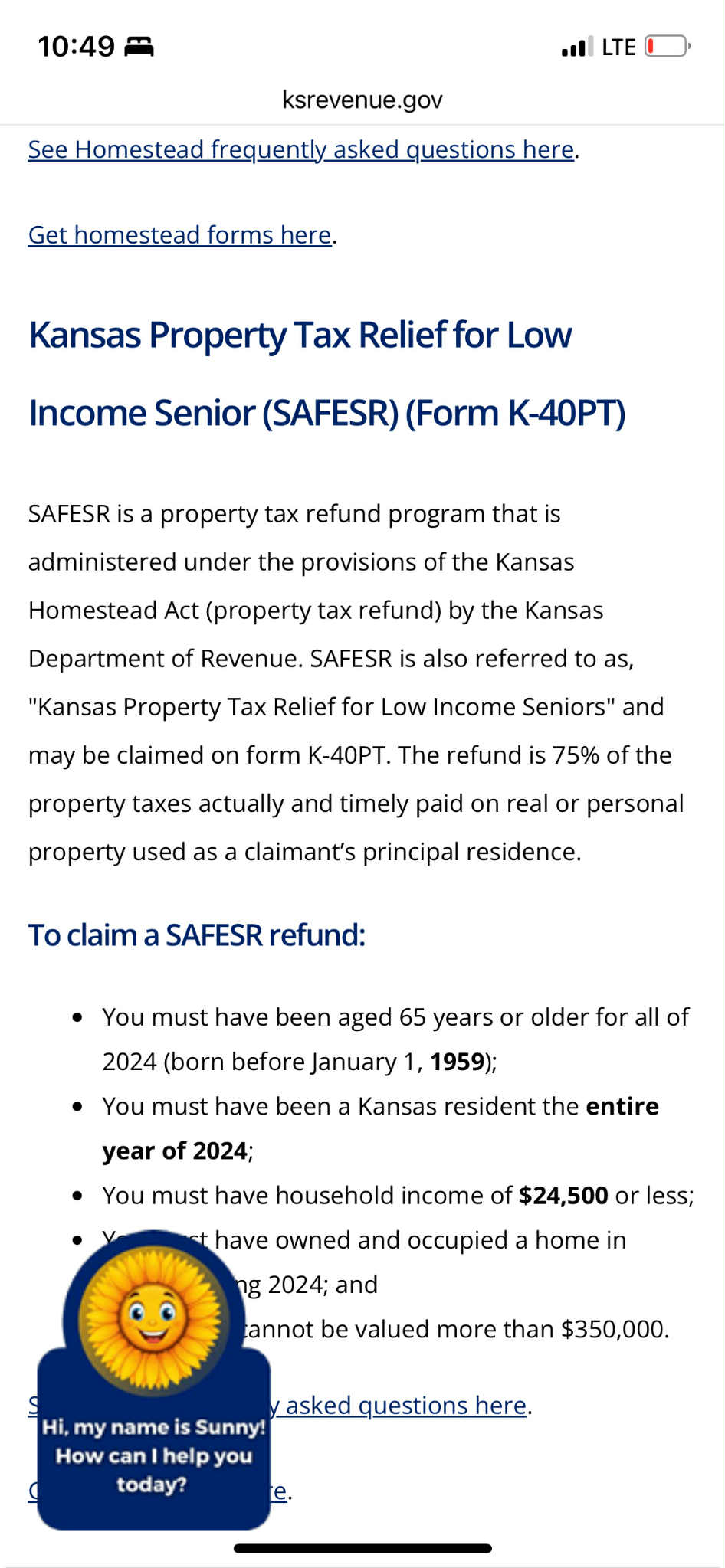

💸 Kansas Property Tax Relief for Low-Income Seniors 💸

Are you 65 or older and a Kansas homeowner on a fixed income? You could get back **75% of your property taxes** through the **Safe Senior Refund** (also known as SAFESR), a state-run relief program just for you! 🙌

✅ **What you need to qualify:**

- 65+ years old for all of 2024

- Income less than or equal to $24,500 (including Social Security)

- Home value must be $350,000 or less

- Kansas resident all year

- Property taxes must be paid on time (no delinquencies)

📅 You can apply between **January 1 and April 15, 2025** using **Form K‑40PT** to claim your refund. The refund is processed by the Kansas Department of Revenue and can take 20–24 weeks to arrive.

➡️ **Apply or learn more here:** 👉 https://www.ksrevenue.gov/safesenior.html

This is a huge help for seniors managing on a tight budget. If you or someone you know qualifies, don’t let this money go unclaimed! 💯

#KansasSeniors #PropertyTaxRelief #SafeSeniorRefund #LowIncomeSupport #KansasHelp #TaxRefund #ElderCareResources