1. Understanding Wyandotte County's Current Tax Burden

Wyandotte County residents and businesses face a complex tax structure that significantly impacts their financial well-being. Understanding the current tax burden—including property taxes, sales taxes, and business taxes—is essential to grasp how these rates affect economic growth and quality of life. High tax rates can reduce disposable income for families and limit resources available for local businesses to reinvest and expand. This overview will break down where tax dollars go, how they are collected, and the pressures these taxes place on the county’s economy. By recognizing the current tax landscape, community members can better advocate for balanced tax policies that promote fairness and encourage sustainable development.

2. How High Taxes Affect Local Small Businesses

Small businesses are the backbone of Wyandotte County’s economy, yet they often struggle under the weight of high taxes. Elevated tax rates increase operating costs, reduce profit margins, and limit the ability to hire new employees or expand services. Many small business owners face difficult choices between paying taxes or investing in growth initiatives. This burden can discourage entrepreneurship and push potential new businesses out of the market. In contrast, competitive tax policies can foster a thriving business environment that supports innovation, job creation, and economic diversification. Understanding this dynamic is key to developing tax strategies that empower small businesses rather than hinder them.

3. The Role of Property Taxes in Wyandotte’s Economy

Property taxes are a primary source of revenue for Wyandotte County, funding schools, infrastructure, and public safety. However, high property taxes can discourage homeownership, strain household budgets, and reduce disposable income for residents. For landlords and real estate investors, elevated taxes often translate into higher rents, impacting housing affordability across the county. Balancing the need for adequate funding of public services with reasonable property tax rates is crucial to maintaining a stable housing market and supporting economic growth. This section will analyze how property tax policies influence both residential and commercial development within Wyandotte County.

4. Impact of Sales Tax on Consumer Spending

Sales tax directly affects consumers’ purchasing power and, by extension, the vitality of local businesses. When sales taxes are high, consumers may limit discretionary spending or shop outside the county to save money, causing a leakage of potential revenue. This decrease in consumer demand can negatively impact retailers, service providers, and local tax collections. Conversely, lower sales taxes can encourage more spending within Wyandotte County, boosting local business revenues and increasing overall economic activity. Exploring the relationship between sales tax rates and consumer behavior helps illustrate how tax policy decisions influence everyday life and community prosperity.

5. Tax Incentives as a Tool for Economic Growth

Tax incentives are powerful tools that Wyandotte County can leverage to attract businesses, create jobs, and stimulate investment. Offering targeted tax breaks or credits encourages companies to relocate or expand operations within the county. These incentives can support key industries, foster innovation, and increase the county’s tax base over time. However, incentives must be carefully designed to ensure they provide real economic benefits without creating undue budgetary strain. Transparent criteria and regular evaluations are essential to maximize the positive impact of tax incentives while safeguarding public resources. This section explores best practices and potential opportunities for Wyandotte County.

6. Reducing Taxes to Combat Population Decline

Wyandotte County has experienced population stagnation and decline in certain areas, which negatively impacts the local economy and tax base. High taxes can be a deterrent for both current residents and potential newcomers considering relocation. Lowering taxes can make the county more attractive by improving affordability, encouraging home purchases, and retaining families. In turn, a growing population boosts demand for goods and services, stimulates local business activity, and broadens the tax base. This section discusses strategies for tax reduction aimed at reversing population decline and fostering a vibrant, thriving community.

7. Wyandotte County’s Tax Comparison with Neighboring Counties

Comparing Wyandotte County’s tax rates with those of surrounding counties provides valuable insights into its competitiveness and attractiveness for residents and businesses. If tax rates are significantly higher here, it may discourage investment and relocation, pushing people and companies to neighboring areas. This analysis highlights where Wyandotte stands in relation to others in property tax, sales tax, and business taxes. Understanding this competitive landscape allows policymakers and citizens to make informed decisions about tax reforms that will better position the county to retain and attract economic activity.

8. The Importance of Fiscal Responsibility in County Spending

Effective tax policy goes hand in hand with fiscal responsibility in government spending. Taxpayers want assurance their contributions are used efficiently and transparently to fund essential services without waste. Fiscal discipline helps avoid unnecessary tax increases while maintaining quality public programs. By implementing cost-saving measures, prioritizing critical projects, and reducing bureaucratic overhead, Wyandotte County can maintain a healthy budget that supports growth without overburdening taxpayers. This section emphasizes the link between spending practices and tax policy, encouraging a culture of accountability and stewardship in county governance.

9. How Lower Taxes Encourage Entrepreneurship

Entrepreneurship is a key driver of economic innovation and job creation in Wyandotte County. Lower taxes create a more favorable environment for startups and small businesses by reducing initial and ongoing financial barriers. This encourages individuals to take risks and invest in new ventures, leading to a diversified economy and more resilient local market. Moreover, reduced tax burdens can free up capital for entrepreneurs to reinvest in their businesses, hire employees, and expand operations. This section explores the connection between tax policy and the entrepreneurial ecosystem, highlighting ways to foster innovation and economic vitality through tax reform.

10. The Connection Between Taxes and Public Services

Taxes fund crucial public services such as education, law enforcement, infrastructure, and healthcare, all of which support Wyandotte County’s quality of life and economic prospects. However, it is important to strike a balance between adequate funding and maintaining competitive tax rates. Overly high taxes can stifle economic growth, while underfunding public services may degrade community well-being and discourage investment. This discussion addresses how Wyandotte County can optimize tax revenues to ensure efficient service delivery while fostering an environment conducive to growth and prosperity.

11. The Impact of Tax Reform on Wyandotte’s Workforce

Tax policies directly influence workforce dynamics by affecting employment levels, wages, and worker retention. High taxes on businesses may limit their capacity to hire or offer competitive salaries, leading to job stagnation or loss. Similarly, excessive personal taxes can discourage workers from living or staying in the county. Thoughtful tax reform can enhance job opportunities, attract skilled workers, and boost labor market participation. This section examines how changes in taxation can improve the county’s workforce outcomes and contribute to a more dynamic local economy.

12. Community Support for Tax Relief Initiatives

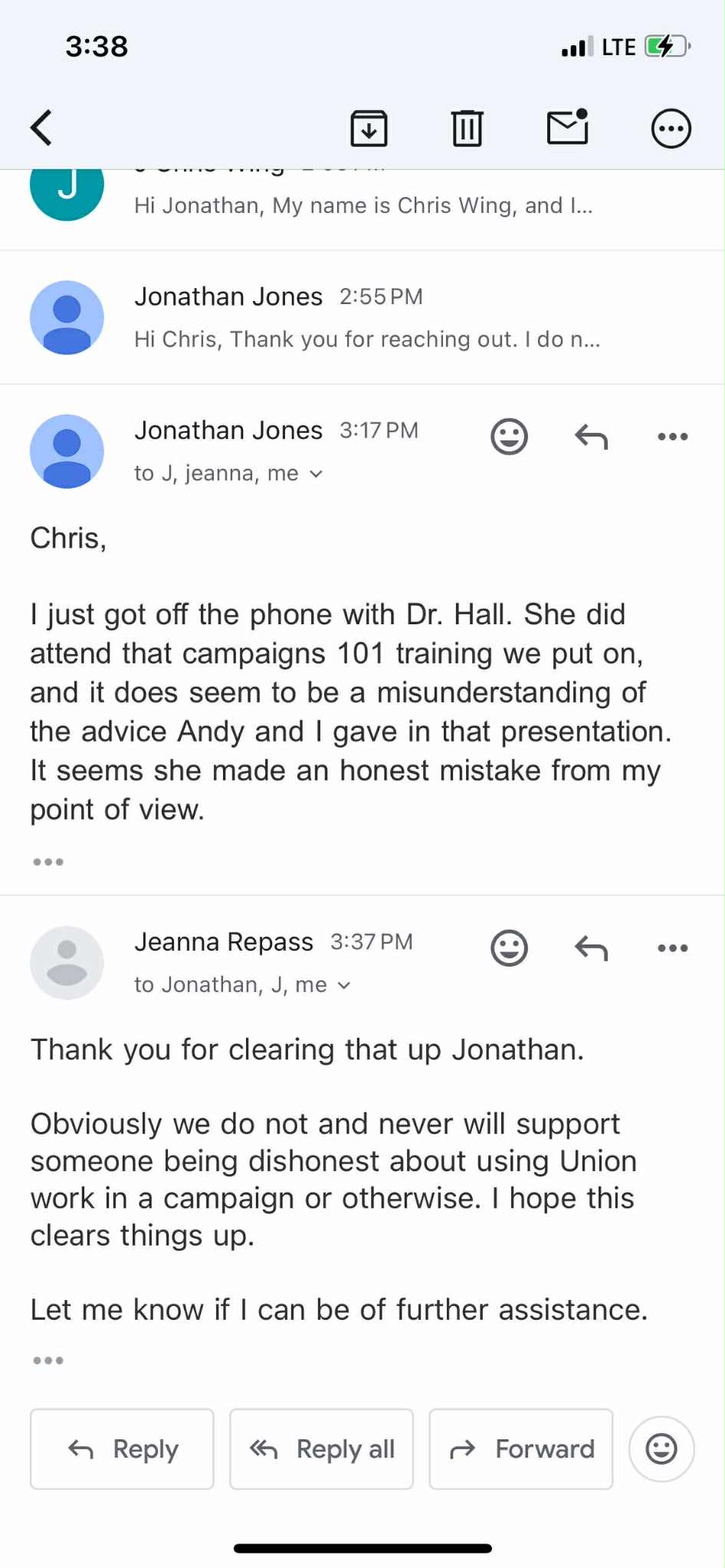

Successful tax reform requires broad community engagement and support. Local organizations, advocacy groups, and citizens play a vital role in promoting tax relief initiatives that align with economic growth objectives. By mobilizing public opinion and participating in policymaking, the community can influence decisions that balance fiscal responsibility with tax reduction. This section highlights current efforts and opportunities for residents to get involved, ensuring that tax policies reflect the needs and priorities of Wyandotte County’s diverse population.

13. Addressing Tax Inequality in Wyandotte County

Tax burdens are not always distributed evenly, with some income groups disproportionately affected by certain taxes. Low-income households may pay a higher percentage of their earnings in sales or property taxes, leading to economic hardship. Addressing tax inequality through targeted relief programs, exemptions, or progressive tax structures can improve fairness and reduce poverty. This section explores how Wyandotte County can design tax policies that promote equity while sustaining revenue for essential services, ensuring that everyone contributes their fair share without undue hardship.

14. Property Tax Caps: Pros and Cons

Implementing caps on property tax increases can provide homeowners and businesses with predictability and relief from sudden tax hikes. Such caps can protect against rapid inflation of tax bills and help maintain housing affordability. However, property tax caps may also limit local government revenues needed to fund schools and infrastructure, potentially resulting in service cuts or alternative tax increases. This section evaluates the benefits and potential drawbacks of property tax caps, offering insight into how Wyandotte County can balance taxpayer protections with fiscal needs.

15. Economic Benefits of Lowering Business Taxes

Lower business taxes can significantly stimulate Wyandotte County’s economy by attracting investment, encouraging expansion, and promoting job creation. Reduced tax rates improve business profitability, allowing companies to reinvest in equipment, technology, and workforce development. This, in turn, enhances the county’s competitiveness and economic diversification. However, lowering business taxes must be strategically planned to ensure that the loss in immediate revenue is offset by long-term economic gains. This section examines potential economic benefits and considerations of reducing business tax rates within the county.

16. The Relationship Between Tax Rates and Real Estate Development

Tax policies directly affect real estate development by influencing investor decisions and housing affordability. High taxes can discourage new construction projects or lead to higher costs passed on to buyers and renters. Conversely, reasonable tax rates encourage developers to invest in residential, commercial, and industrial properties, supporting urban growth and revitalization. This section explores how Wyandotte County’s tax structure impacts development trends and how adjustments can foster a sustainable and vibrant real estate market.

17. How Transparency in Tax Spending Builds Trust

Transparency in how tax revenues are spent is essential for building public trust and encouraging taxpayer compliance. When residents understand where their tax dollars go and see tangible benefits, they are more likely to support tax policies and government initiatives. Wyandotte County can enhance transparency by providing clear, accessible reports, engaging community stakeholders, and openly communicating fiscal decisions. This section discusses the importance of transparency and how it contributes to stronger community-government relationships and more effective tax policy implementation.

18. Leveraging Technology to Improve Tax Collection Efficiency

Technology can modernize Wyandotte County’s tax collection processes, reducing administrative costs and improving accuracy. Digital platforms for tax payments, automated reminders, and data analytics enable efficient tracking and reduce errors or fraud. Improved efficiency means less money spent on collection efforts, potentially allowing for lower tax rates or more effective public service funding. This section examines current technological solutions and future opportunities for Wyandotte County to enhance tax system performance and taxpayer experience.

19. Tax Relief Programs for Low-Income Families

Many low-income families in Wyandotte County struggle with tax burdens that consume a significant portion of their limited income. Tax relief programs such as exemptions, credits, or deferrals can provide essential financial support, helping these families meet basic needs while maintaining community stability. These programs also promote economic mobility and reduce poverty-related issues. This section reviews existing relief programs and potential new initiatives to better assist vulnerable populations in managing their tax responsibilities.

20. The Path Forward: Policy Recommendations for Wyandotte County

To foster a prosperous and equitable economy, Wyandotte County must adopt comprehensive tax policies that balance revenue needs with economic competitiveness. This includes lowering burdensome taxes, improving fiscal management, enhancing transparency, and supporting vulnerable populations. Policymakers should consider a mix of reforms aimed at stimulating business growth, encouraging homeownership, and expanding the tax base without sacrificing essential public services. This concluding section offers actionable recommendations based on best practices and local conditions to guide Wyandotte County toward a more sustainable economic future.